In 2025 the retail baseline has shifted from “fast” to “now.” Quick commerce (Q-commerce) promises delivery in 15–30 minutes and has moved from pandemic experiment to a durable channel in dense cities. The winners are no longer those who shout the lowest ETA on a landing page, but those who can deliver the promise reliably, day after day, with unit economics that survive outside of promotional sugar highs. This article lays out how the model operates, where value is created, and what must be engineered—organizationally and technically—to make Q-commerce a business rather than a subsidy.

Retailers expanding into last-mile delivery.

Logistics and supply chain professionals.

Product and tech leaders in on-demand services.

- Quick commerce (q-commerce) is reshaping consumer expectations by offering deliveries in 15–30 minutes.

- The market is expected to reach €448 billion by 2030, but profitability remains a major challenge.

- Future growth will depend on AI-driven optimization and potentially drone-based logistics.

What Q-Commerce Really Is

Q-commerce is not “ecommerce, but faster.” It is a service built around small, frequent baskets fulfilled from hyperlocal inventory. The operational boundary is tight: service radii of one to three kilometers, assortments of roughly one to two thousand high-turn SKUs, and fulfillment flows designed for seconds—not minutes—per pick. The customer promise is simplicity: what I need, close by, at a predictable price, without cognitive load. Reliability rather than novelty is what keeps users from opening a competitor’s app on the next order.

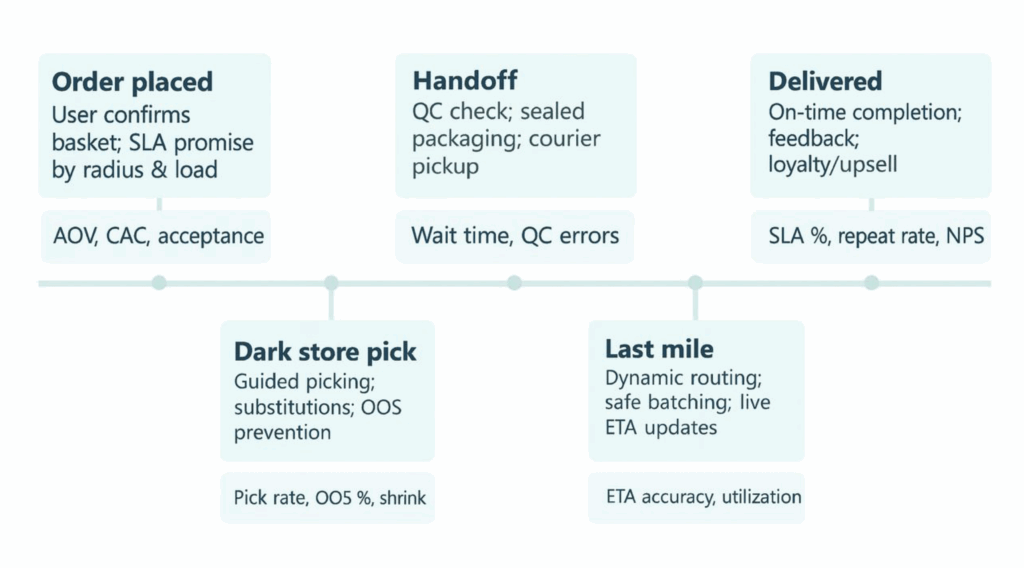

How the 15–30 Minute Promise Is Kept

Speed is the output of three well-tuned subsystems. The first is micro-fulfillment: dark stores placed where demand density is high, with planograms that minimize footsteps and cycle counts that keep on-shelf accuracy near perfect. The second is predictive logistics: demand forecasts position labor and inventory by hour and by neighborhood, and dispatch engines pair the nearest rider with compatible orders, occasionally batching two deliveries on a single trip without jeopardizing the SLA. The third is software-defined operations: live dashboards expose pick rates, queue depth, out-of-stock risk, and lateness reasons, so managers can intervene before the curve bends the wrong way. In mature networks the system says “no” more often than “yes,” temporarily shrinking the service radius during surges to protect reliability and brand trust.

The Market Landscape in 2025

Specialists such as Gopuff, Getir, Flink and Zapp proved demand and the operating playbook; large retailers now compete through partnerships or their own dark-store networks. Capital is more selective than it was in 2021, which forces management teams to trade headline growth for contribution margin discipline. In cities that cannot support multiple dense networks, consolidation is the rational outcome. The lesson from the last cycle is clear: scale helps, but density and repeat purchase are the real moats.

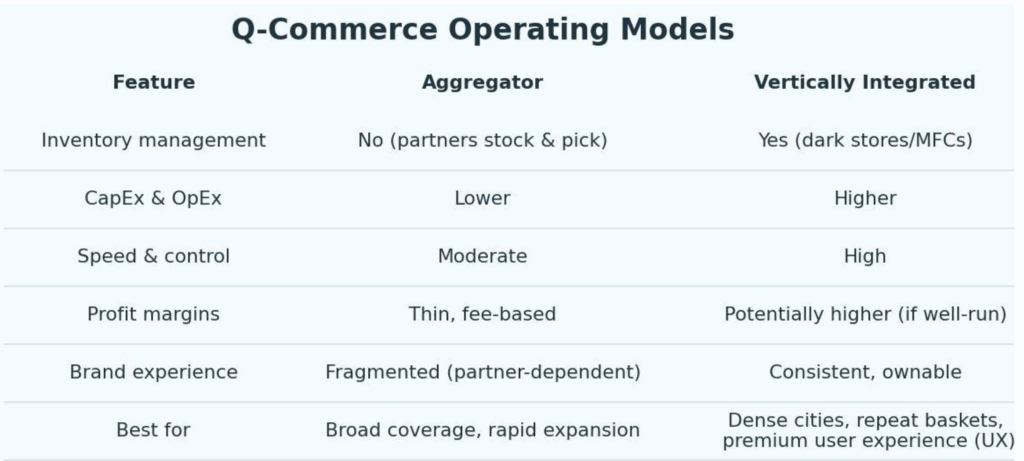

Operating Models: Aggregator vs. Vertical Integration

Two patterns dominate. Aggregators orchestrate delivery for third-party stores and do not own inventory. They expand quickly, require less capital, and monetize through fees, but their control over assortment, picking quality, and margin is limited. Vertically integrated operators run dark stores and own the full experience. They decide the range, the planogram, and the price, and they capture more value per order—at the cost of leases, staffing, and working capital. A pragmatic path is to validate demand with an aggregator footprint, then convert dense zones to vertical operations where basket repeatability justifies fixed costs.

Making the Economics Work

Healthy Q-commerce is built on contribution margin per order, not GMV. Average order value, gross margin, cost to pick, cost to deliver, packaging, refunds and promotions determine whether each order helps or hurts. In practice that means AOVs in the high-teens to mid-twenties for grocery-heavy baskets, pick rates north of a hundred lines per hour in stable stores, and rider utilization that keeps paid minutes concentrated on active jobs rather than idle waiting. Promise control protects the P&L as much as reputation: if a zone is spiking, it is better to decline a marginal order than to accept it and miss the SLA, pay compensation, and lose the next three orders from that user.

Technology Architecture That Scales

A production-grade stack is straightforward in concept and demanding in execution. The customer and rider apps must be fast, crash-free, and instrumented for real behavior rather than vanity events. Order management, dispatch, and geofencing need deterministic behavior under load and graceful degradation when mapping services hiccup. Inventory accuracy lives and dies with micro-fulfillment tooling: slotting, guided picking, real-time stock corrections, and substitution logic that respects dietary or regulatory constraints. A streaming data layer feeds a feature store for forecasting, ETA prediction, next-best-action recommendations, and fraud defense. Observability is a product in its own right: heatmaps for late orders, store-level profitability, and experiments visible at the level where managers make decisions.

Operational Risks You Cannot Ignore

The obvious risk is labor. Couriers’ safety, scheduling fairness, and classification issues must be solved in the model rather than patched with incentives. Municipal rules around dark stores, delivery windows, and noise can change the feasibility of a zone overnight. Food safety and recalls demand traceability across the micro-fulfillment network. The most expensive errors are configuration mistakes that degrade promise quality silently—an over-wide service radius, a planogram drift that adds twenty seconds per pick, or surge pricing that backfires and shifts demand to the next app.

Ready to pilot 15-minute delivery? Let’s talk.

Contact UsWhat Changes Next (2025–2028)

The practical ceiling on speed has largely been reached; the frontier is profitability and differentiation. Expect more automation where payback is clear—pick-to-light, micro-sortation, and narrow robotic tasks in high-volume stores. Drones will extend rings in specific suburban corridors, but urban cores will remain ground-first for the foreseeable future due to regulation and weather. Sustainability will move from marketing to procurement: cargo bikes and EVs become default, packaging weight is designed down, and reverse logistics is paired with delivery runs. Above all, networks that learn—hourly, by zone, by SKU—compound their advantage.

Conclusion

Q-commerce succeeds when speed is the consequence of design, not a marketing claim. The durable operators in 2025 pair dense, well-run micro-fulfillment with conservative promise control, transparent operations, and a data loop that tunes the network every hour. If you treat reliability as the brand and contribution margin as the north star, a 15-minute promise becomes not just achievable—but investable.

Why Ficus Technologies?

Ficus Technologies builds the systems that make the above real: dispatch engines that protect SLAs under pressure, inventory platforms that keep accuracy high in micro-fulfillment, and data pipelines that turn raw events into forecasts and actions. We deliver rider and customer apps with feature flags and staged rollouts, stand up operational dashboards that expose contribution margin by zone, and embed ML models for demand, ETA, and next-best-action. For teams at the starting line, we run a two-week blueprint that maps zones, models unit economics, and produces an architecture and delivery plan you can execute.

Q-commerce focuses on delivering smaller orders in under an hour, often using local dark stores. Traditional ecommerce may take days and relies on larger fulfillment centers.

Currently, many companies operate at a loss due to high logistics costs and low margins. However, profitability may improve through scale, automation, and loyalty.

High-frequency items like snacks, drinks, OTC medicine, and groceries are ideal due to their urgency and repeat-purchase nature.

AI for route optimization and personalization, mobile apps for user experience, and MFC systems for localized inventory.