Selecting financial analytics software is no longer a tooling choice; it’s an operating decision that shapes how quickly your company can see reality, model scenarios, and act with confidence. The right platform reduces cycle time from question to answer, improves the accuracy and consistency of reporting, and gives finance and business leaders a shared view of performance. The wrong fit creates hidden costs: manual workarounds, competing versions of the truth, and dashboards nobody trusts.

This guide takes a pragmatic look at leading options in the market and, more importantly, the decision criteria that actually matter in implementation. You’ll find concise snapshots of well-known tools, an explanation of where each tends to shine, and a straightforward approach to choosing and rolling out a solution that fits your context.

Whether you’re a startup founder needing simple cash flow tools like Clockwork, a mid-sized company seeking Excel-friendly solutions like Cube or Datarails, or a large enterprise requiring robust platforms like Oracle Essbase and NetSuite, you’ll find valuable insights here.

It’s also perfect for teams exploring AI-driven analytics with ThoughtSpot or Workday Adaptive Planning, as well as those integrating with existing ERP systems.

- Diverse tools cater to all business sizes, from QuickBooks for SMBs to Anaplan for large-scale forecasting.

- Integration flexibility (e.g., NetSuite, Sage Intacct) and ease of use (e.g., Cube, Clockwork) are critical for success.

- Costs vary widely, from affordable options like QuickBooks to premium solutions like Anaplan ($30,000-$50,000+).

How to Frame the Decision

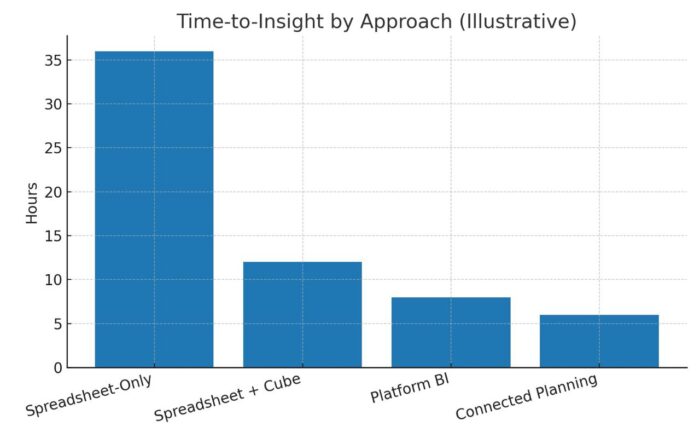

Before comparing products, anchor the choice in your use cases and operating model. If finance is heavily spreadsheet-centric and needs to move fast on planning cycles, a spreadsheet-native FP&A layer can be a strong bridge. If your business runs on a cloud ERP and you need governed, cross-functional analytics, a platform approach with a robust data model and semantic layer will scale better. Think about data geography (multiple entities and currencies), the cadence of planning and forecasting, the level of self-service you want to enable, and the systems you must integrate (ERP, CRM, commerce, data warehouse). The best software is the one that your teams can adopt, govern, and extend without heroic effort.

Top Financial Analysis Tools

These tools offer diverse features and pricing, tackling everything from data management to detailed reporting:

- ThoughtSpot: An AI-powered analytics platform providing a 360-degree view of financial performance with natural language queries and interactive dashboards, ideal for real-time insights. Businesses can ask questions like “What’s our revenue trend?” and get instant visualizations. Its strength lies in accessibility for non-technical users, though it may require integration effort with existing systems. Perfect for enterprises needing agile decision-making.

- Workday Adaptive Planning: A cloud-based solution with AI-driven forecasting and scenario modeling, starting at $15,000, perfect for seamless ERP integration.

It offers drag-and-drop dashboards and supports complex planning across workforce, sales, and finance. Users praise its scalability, but the learning curve and lack of native Excel integration can be drawbacks for some teams. - Cube: A spreadsheet-friendly FP&A platform with Excel/Google Sheets integration, saving time on consolidation and focusing teams on strategy. Starting at $2,000/month, it’s ideal for small to mid-sized businesses seeking a balance of familiarity and automation. Its limitation is handling very complex, multi-dimensional models, making it less suited for large enterprises.

- Datarails: An FP&A platform enhancing Excel with automation for reporting and forecasting, suitable for mid-sized businesses seeking efficiency. It supports over 200 integrations, including QuickBooks and Salesforce, and offers real-time dashboards. However, Mac compatibility and large data handling can pose challenges during initial setup.

- Oracle Essbase: A multidimensional database for OLAP and BI, featuring Smart View for easy reporting and Oracle BI compatibility. It excels in scenario analysis and large-scale data modeling, though its complex interface and slow calculation times can frustrate users. Best for organizations already in the Oracle ecosystem.

- Limelight: A cloud-based tool offering automated budgeting, predictive analytics, and real-time reporting, adaptable for businesses of all sizes. Its flexibility stands out, but pricing details are custom, which may require negotiation. It’s a strong contender for teams needing scalable financial oversight.

- QuickBooks: Intuit’s accounting gem for SMBs, with invoicing, payroll, and cloud-based reporting. Since 1983, it’s evolved with a user-friendly interface, though it lacks advanced features for scaling businesses. Ideal for freelancers and small teams starting out.

- SolveXia: An end-to-end automation suite with real-time insights, designed to execute processes 85x faster, ideal for financial teams seeking scalability. Its strength is automation, but it may need customization for unique workflows. Perfect for large teams aiming to reduce manual effort.

- NetSuite: A cloud ERP with financial analytics and CRM, delivering real-time insights. Used by over 41,000 organizations, it integrates inventory and sales data, though custom pricing can be a barrier. Best for businesses already invested in Oracle’s ecosystem.

- Clockwork: A simple cash flow forecasting tool for startups and small businesses, offering real-time projections with easy setup. Its lightweight design is a plus for beginners, but it lacks advanced features for complex planning. Great for cash flow-focused startups.

- Sage Intacct: Tailored for SMBs, offering real-time dashboards and streamlined accounting. With Salesforce integration and 150+ built-in reports, it boosts efficiency, though higher-tier plans are needed for advanced features. Ideal for growing businesses needing customization.

- Jedox: An EPM tool for budgeting and scenario analysis, unifying finance teams. Its Excel-like interface and AI-assisted planning shine, though initial training can be time-intensive. Starting at $50/user/month, it’s suited for enterprises needing integrated planning.

Discover which financial tool fits you best!

Contact UsImplementation That Works in the Real World

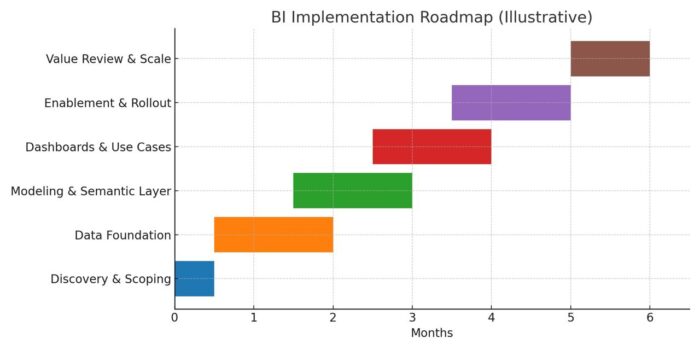

Successful deployments follow a few durable principles. Start by defining the decisions you need to support and the KPIs that matter, then design a data model that encodes those definitions once. Build a minimal but reliable integration layer—automated, testable, and monitored—so refreshes are predictable. Establish a semantic layer or governed set of metrics to prevent drift across dashboards. Roll out in increments: a high-value domain first (for example, revenue and margin), then expand to opex, working capital, and forecasting. Invest in enablement so finance and business users can self-serve within guardrails. Finally, treat quality and trust as product features: log lineage, document metric logic, and monitor data reliability like uptime.

Conclusion

Financial analytics software does its best work when it aligns with how your organization plans, measures, and decides. If you pair the right platform with a clear model, disciplined integrations, and practical enablement, you’ll shorten planning cycles, raise reporting quality, and give leaders a dependable view of performance. Start with the decisions, choose the tool that fits, and implement in increments—your finance function (and the rest of the business) will feel the difference quickly.

Why Ficus Technologies?

Ficus Technologies designs BI and FP&A solutions around business outcomes, not tool logos. We help clients define the decisions that matter, implement a clean data model and reliable pipelines, and stand up the right mix of planning and analytics tools for their context. Our approach is vendor-neutral, governance-first, and adoption-driven: we build what teams will actually use, and we measure value in cycle time, accuracy, and confidence.

For small businesses, QuickBooks is an excellent choice due to its simplicity and affordability, or Clockwork for a focus on cash flow forecasting.

Basic Excel skills are enough for initial use, but complex scenarios may require training or support from a specialist.

Yes, ThoughtSpot supports integration with most ERP and BI systems, though configuration may be needed for optimal performance.